It’s not easy to defend a failing flagship policy, especially when the central premise is shaky. When the foundation is built on wishful thinking, the supporting ‘evidence’ is bound to stray into fiction too.

People gather at the entry gate of a bank to exchange and deposit their old high denomination banknotes in Jammu, India November 15, 2016. Credit: Reuters/Mukesh Gupta

Despite the frenzy of distractions since, by now you have likely heard the news that demonetisation failed. As NDTV’s Sreenivasan Jain put it in Truth vs Hype, the news sent the government into “a spiral of deflection, of moving goalposts and of swamping us with cherry-picked data”. He’s being very polite, avoiding the accurate and efficient word: “lies”.

1. ‘We always expected all the cash to come back in’

Take this blatant example from the 31 Aug 2017 Ministry of Finance release titled “Demonetisation immensely beneficial to Indian Economy and People”:

The government had expected all the SBNs to come back to the banking system to become effectively usable currency.

Advertisement

Oh yeah? Here are four examples that show otherwise:

- In his November 8 speech, Prime Minister Narendra Modi stated: “The 500 and 1,000 rupee notes hoarded by anti-national and anti-social elements will become just worthless pieces of paper.”

- Two days later, Finance Minister Arun Jaitley told News18 that, of the 14 lakh crore notes outstanding, “some would certainly get extinguished” because “people who have used cash for crime purposes are not foolhardy enough to try and risk and bring the cash back into the system”.

- On 10 Dec, Attorney General Mukul Rohtagi informed the Supreme Court that “the government had expected ₹10 or 11 lakh crore to be returned out of a total of ₹15 lakh crore of ₹500 and ₹1,000 notes that were demonetised”.

- One month later, on 10 Jan, NITI Aayog member Bibek Debroy predicted that some 10% of the notes in circulation would not return.

Some other big holes in the government’s defence of demonetisation are now widely acknowledged. That the proportion of fake notes in the system is small and remains so, and that the cash crunch failed to impede the activities of militants in Kashmir and in Naxalite areas (here, here and here). That demonetisation has brought in fewer taxpayers than the government claims.

So what’s left to be said?

Quite a bit, it turns out. The big fibs are defended by a ring of smaller lies and half-truths, to the point that honesty seems absent in the entire defence of demonetisation. It’s one thing for politicians to spin or massage the truth, quite another for an official government statement to do so.

Let’s look at the other claims in that document, one by one.

2. Huge seizure of black money?

A significant portion of SBNs deposited could possibly be representing unexplained/black money… Since November 2016 and until the end of May 2017, a total of Rs 17,526 crore has been found as undisclosed income and Rs 1003 Crore has been seized.

Duh, that’s obviously what happened. It is possible that the income tax department’s Operation Clean Money exposes a good proportion of that money in the coming months, and thereby contributes to the original goals of demonetisation. But the evidence so far is unimpressive.

₹17,256 crore sounds like a lot, but is actually well within historical averages, even if we exclude the unusually large 2013-14 haul – which we really shouldn’t since demonetisation was supposed to be this bold, never-seen-before move (see chart below). The best-case scenario is that future revelations await, the worst-case scenario is that wily citizens successfully convert black money to white.

Takeaway: Wake us up when you have something solid.

3. Mutual fund growth?

The total assets under management (AUM) of Mutual funds (MFs) rose by 54% by the end of June 2017 from March 2016.

This is simply ridiculous as a defence of demonetisation. The bulk of this asset growth happened prior to demonetisation, between Apr and Oct 2016, when it rose 32% (according Association of Mutual Funds in India data). Following demonetisation, mutual funds assets grew a more subdued 16% between Nov 2016 and Jun 2017. But 54% sounds so much cooler than 16%, doesn’t it?

Takeaway: They do take us for fools.

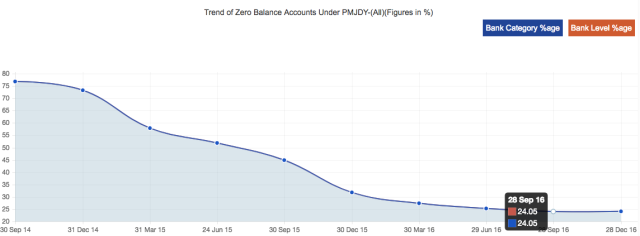

4. Fall in zero balance Jan Dhan Yojana accounts?

Thanks to demonetization led efforts, zero balance accounts under PMJDY declined from 76.81 % in September 2014 to 21.41% in August 2017.

More bunkum, I’m afraid. The proportion of zero balance Jan Dhan Yojana accounts had already fallen to 24.1% by 26 Sep 2016, several weeks prior to the demonetisation announcement. In fact, the reduction from 24.1% to 21.4% that occurred after demonetisation is the slowest since 2014 (see chart below), quite the opposite of what the Finance Ministry is implying.

Takeaway: Still taking us for fools.

5. Aadhar linkage to accounts?

As part of fillip to digitalization, about 52.4 crore unique Aadhaar numbers have been linked to 73.62 crore accounts in India. As a result, every month now, about 7 crore successful payments are made by the poor using their Aadhaar identification. The government now makes direct transfer of Rs. 74,000 crore to the financial accounts of 35 crore beneficiaries annually, at more than Rs. 6,000 crore per month.

Congratulations, but this has nothing to do with demonetisation. It’s to do with Aadhaar and PMJDY, which were ticking along nicely long before demonetisation, and would have continued to do that in its absence.

Takeaway: Irrelevant.

6. Rise in digital payments?

Digital payments have increased by 56% from 71.27 crore transactions in October 2016 to 111.45 crore transaction till the end of May, 2017.

This implies steady growth in digital transactions, when in fact the Ministry of Electronics and Information Technology – clearly more honest than the Finance Ministry – admitted in the Lok Sabha on 2 Aug that “digital transactions increased during November-December 2016 and have plateaued thereafter”. In other words, people shifted to digital payments when they had no cash, got accustomed to it to some extent, and reverted to their old habits. This is clear in the chart below — and recent National Payments Corporation of India data show no increase in later months either.

So we sacrificed millions of jobs and two percentage points of economic growth for a temporary bump in the growth rate of digital payments.

Takeaway: If only the spin would also plateau.

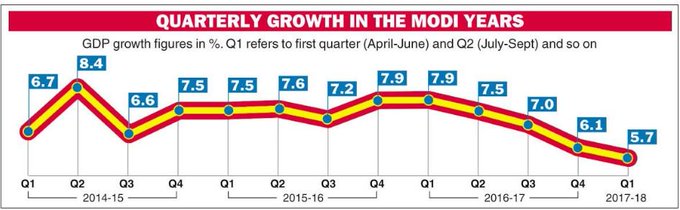

7. Doomsday predictions on lower growth belied?

Some people had expected a very large shock to economic growth on account of demonetisation. Their expectations have been belied.

I don’t know what the Finance Ministry is smoking, but it’s obviously potent stuff (see below). To be fair, the 5.7% GDP number came out the day after the demonetisation defence, but the 6.1% growth in Q4/2016-17 was already down 1.8 percentage points from 7.9% in Q4/2015-16. The only expectations belied here are the Finance Ministry’s.