Why IndusInd Bank’s Rejection of an Independent Director’s Reappointment Raises Concerns

Directors’ role on company boards has become more complex and demanding, especially for independent directors. Increasingly, they have to monitor and manage diverse stakeholders’ interests, instead of being primarily focused on protecting shareholders‘ interests and expectations. In the context of banks, this was evident when an independent director of IndusInd Bank sought reappointment from shareholders.

The reappointment, which had the support of the founders, promoters and the executive management, required the approval of 75% of voting shareholders.

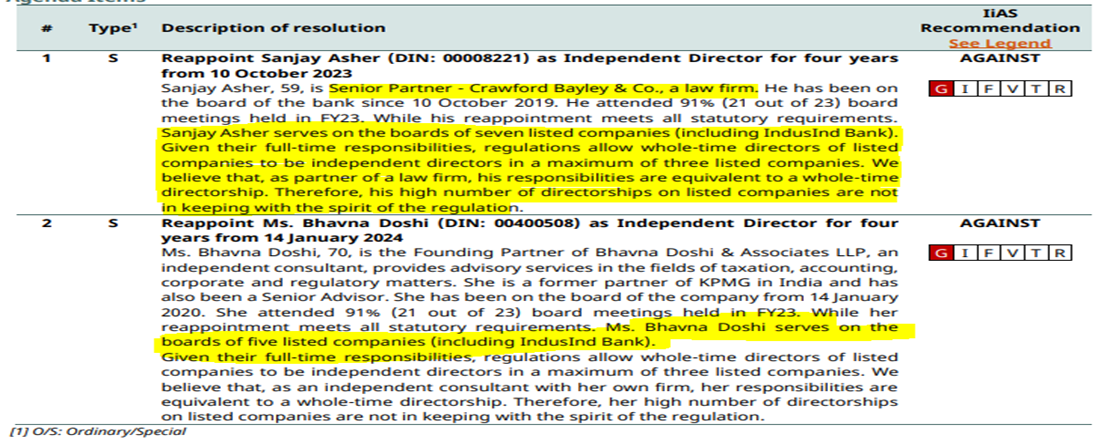

On October 5, 2023, the bank's shareholders rejected the reappointment of Sanjay Asher, senior partner of the prestigious law firm Crawford Bayley and Company, as independent director. This development should raise alarm bells within India’s corporate world. This is because the shareholders’ rejection was not based on any lack of competence on Asher’s part, but because the proxy advisory firms recommended his rejection. The proxy firms did so because Asher was a partner in a law firm, and he was equivalent to a whole-time (executive) director there.

As per the Securities and Exchange Board of India (SEBI) regulations, a whole-time director can be an independent director in a maximum of three listed companies. SEBI regulations further allow that independent directors have a maximum of seven directorships. Asher was on seven boards as an independent director. Hence, not only was he conforming to SEBI regulations for independent directors, he was also considered ‘fit and proper’, as per Reserve Bank of India (RBI) norms for directors.

Institutional Investor Advisory’s Services (IiAS) Recommendations on IndusInd Bank’s Resolutions. Source: IiAS

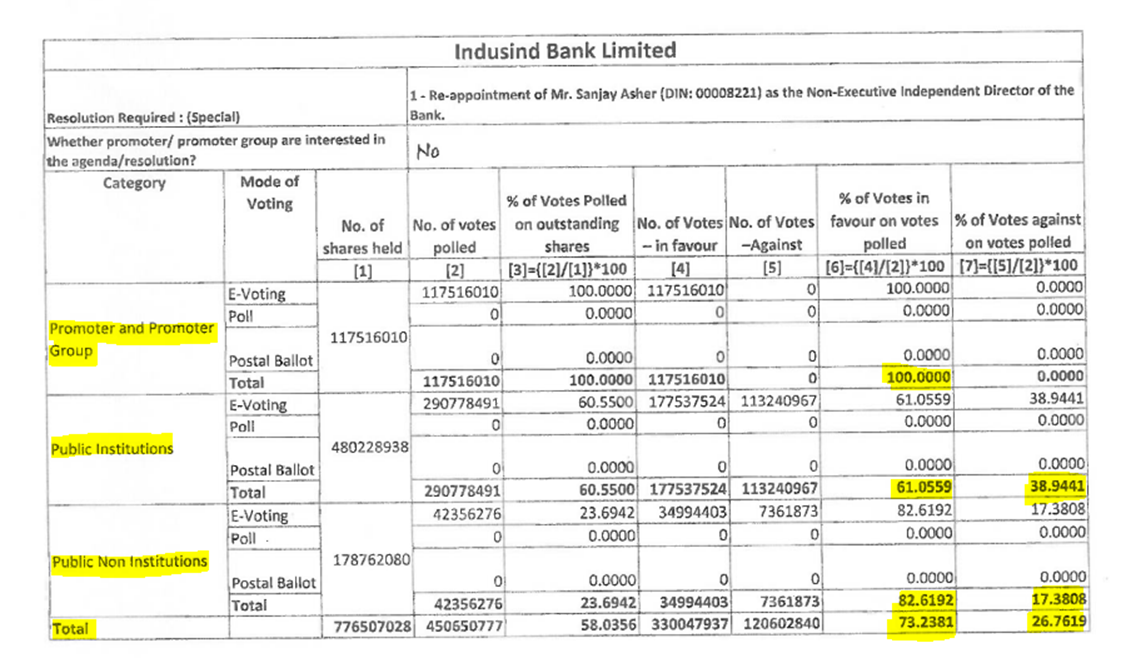

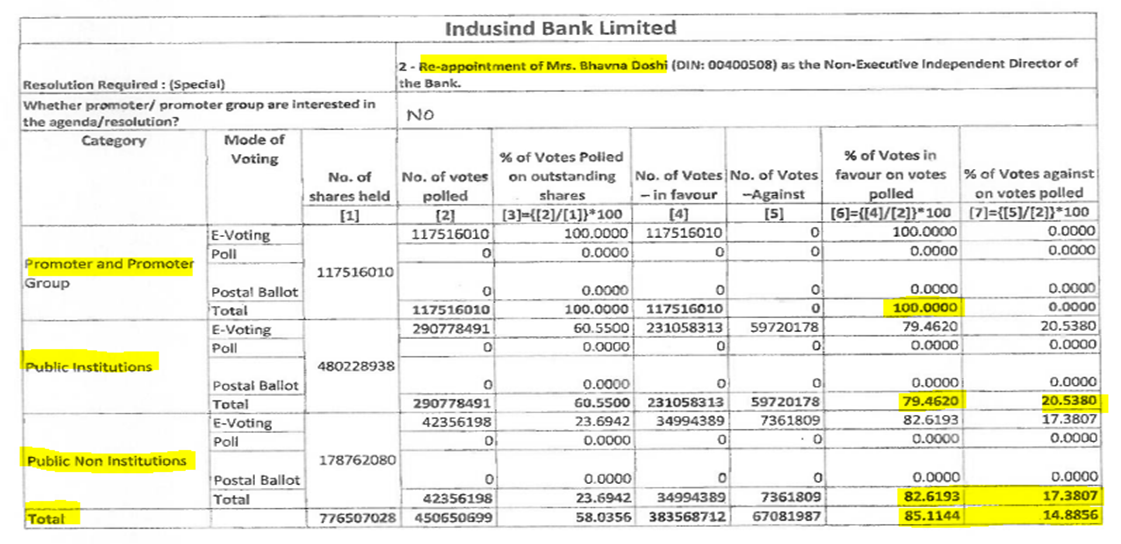

Votes Polled by IndusInd Bank’s Shareholders on the Resolutions. Source: BSE

Interestingly, while Asher narrowly failed to get the required majority, as 26.8% of the shareholders rejected his reappointment, another independent director, whose reappointment the advisory firms had recommended against on similar grounds, was reappointed with 85.1% of the shareholders' voting in her favour.

Source: BSE

There are lessons which need to be urgently learnt by corporate boards from this episode.

Merely adhering to the prevalent regulations is insufficient to save the board from a major public embarrassment. In the case of IndusInd Bank, the board of directors, in recommending the continuance of both independent directors, conformed to all the regulations, but unfortunately the advisory firms were of the view that independent directors who are partners in professional firms should have a maximum of three directorships, and not seven, as mandated by the capital markets regulator.

Corporate boards now have to take such views into consideration in decision-making, as proxy advisory firms wield considerable influence, and can overturn decisions, especially in cases which require the passing of a special resolution with a 75% majority. On account of the considerable influence proxy advisory firms have over institutional investors, boards cannot afford to ignore their views in such cases.

IndusInd Bank’s stakeholders' relationship committee, as on March 31, 2023

| Name | Designation |

| Rajiv Agarwal | Chairman, SRC – Independent Director |

| Bhavna Doshi | Member, SRC – Independent Director |

| Sumant Kathpalia | Member, SRC – Managing Director and CEO |

Source: IndusInd Bank

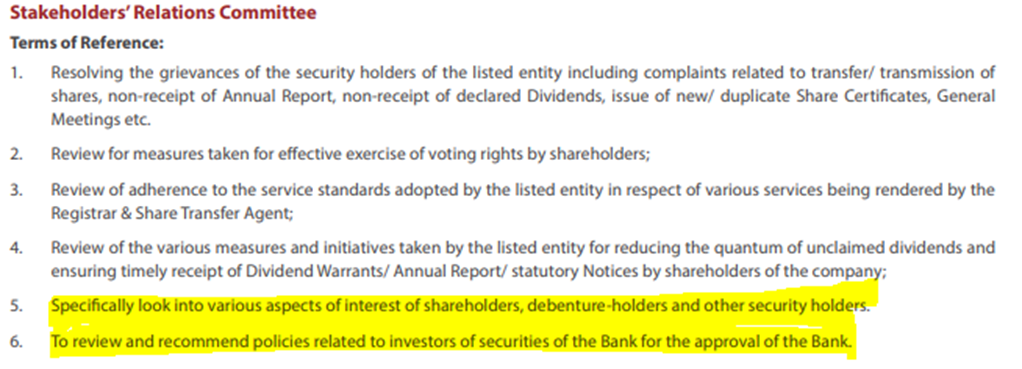

Typically, the stakeholders' relationship committee (SRC) of the board of directors is tasked with considering stakeholders’ concerns and interests. However, the committee has traditionally confined itself to shareholder grievances. Moreover, the terms of reference are restricted to only shareholders and security holders.

Terms of reference for IndusInd Bank’s SRC

Source: IndusInd Bank

As the name suggests that the committee is tasked with the concerns of stakeholders, it needs to to broaden its role to also include depositors, employees, regulators, proxy advisory firms and analysts.

As banks play a critical role in the economy, the role of the SRC has to be strengthened, and members have to take a more active interest in its workings. Expanding the responsibilities of the SRC will enhance its importance within the board and the company.

In private sector banks, the SRCs have failed to protect the interests of employees, as seen in the high attrition of 31% to 51% in some of the banks in FY23. This concern has prompted the RBI to publicly express its apprehensions. The SRCs need to be activated, and have to take cognizance of material information that is brought to their knowledge, including non-public information.

By engaging and being receptive to stakeholders, the SRCs can adopt a forward-looking approach. To operate successfully, the SRCs would need to be more proactive and engage with employee representatives, which is difficult in many private sector banks in the absence of staff unions and officer associations. Seeking advice from proxy advisory firms and even analysts covering the concerned companies may be crucial.

The rejection of the renewal of the term of an independent director by IndusInd Bank shareholders, despite it being supported by the founder and the board, is a major embarrassment.

Even though the renewal complied with regulatory norms, the rejection highlights the board’s lack of concern for current governance norms, and the failure of the bank’s SRC in briefing the board regarding the concerns of proxy advisory firms. Company boards have an organisational structure, in the form of the SRC, to address these issues, but this structure needs to be activated in order to improve governance in companies.

Hemindra Hazari is a Securities and Exchange Board of India (SEBI) registered independent research analyst.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in all the companies mentioned in this report. HDFC Bank subscribes to this analyst’s research and a member of this analyst’s family is employed with the bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: hkh@hemindrahazari.com

This article went live on December fifth, two thousand twenty three, at thirty minutes past three in the afternoon.The Wire is now on WhatsApp. Follow our channel for sharp analysis and opinions on the latest developments.