The raison d’etre of credit rating agencies (CRAs) is to anticipate events such as defaults before they occur. With access to companies’ privileged information, they can detect early signs of problems and warn the markets. CRAs’ credit ratings thereby actually enhance the efficiency and liquidity of the capital markets. That is, at least, the theory. When they fail at their job, they undermine broader confidence in the market.

Globally, the credibility of the major CRAs suffered a huge blow after the sub-prime mortgage meltdown and the collapse of Lehman in September 2008. In India, the CRAs were caught napping in the collapse of IL&FS (rated ‘AA+’ when it defaulted in September 2018; it had an ‘AAA’ rating in August 2018); this had a severe domino impact on the debt market. For the CRAs, IL&FS was not the exception: it was followed by Cox and Kings (commercial paper default in June 2019 when it had the highest ‘A1+’ rating), Altico Capital India (default in September 2019 when it had a ‘AA-/Stable outlook’ rating) and Yes Bank (moratorium in March 2020 when most of its securities were rated as ‘A’ though with a negative outlook).

Have CRAs learnt their lessons and cleaned up their act? We do not know as yet, but the case of AGS Transact Technologies (AGSTT) is a disturbing sign. AGSTT defaulted on its bank borrowing and statutory dues at end-December 2024. At the time, it had an ‘A/Stable Outlook’ rating from CRISIL (subsidiary of S&P Global) and an ‘IND A/Stable and IND A1 rating from India Rating and Research (Fitch Group Company). The CRAs downgraded the company to ‘D’ (default) on February 4, 2025.

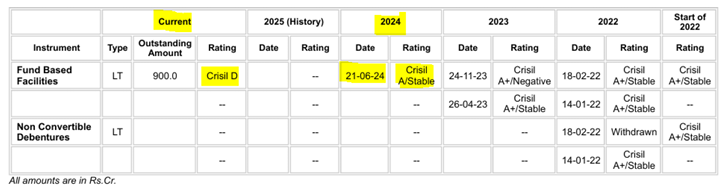

CRISIL’s Rating History of AGSTT for the Last 3 Years

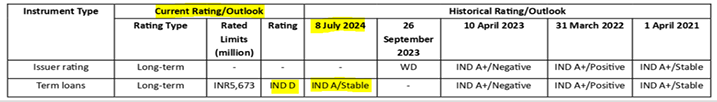

India Rating History of AGSTT

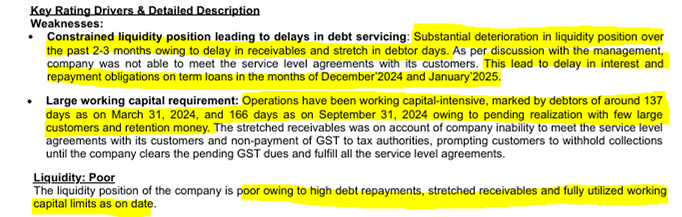

Explaining AGSTT’s default, CRISIL attributed it “to the substantial deterioration in liquidity over the past 2-3 months owing to the delay in receivables and stretch in debtor days…of around 137 days as on March 31, 2024 and 166 days as on September 31 [sic], 2024.”

Extract from CRISIL Downgrade of AGSTT

The overnight downgrade by CRISIL/India Rating by 5 grades (higher if +/- notches are included) from ‘A/Stable’ with a “low credit risk” to ‘D’ after an actual default, should alert the capital market and the regulator to the state of affairs in India’s CRAs. While CRAs may claim that there was a sudden and perhaps unexpected deterioration in the company, an actual default is normally not an overnight phenomenon. It takes some time to develop, and there are warning signals in the company’s public disclosures, let alone in the privileged reporting to which the CRAs have access.

History of important events at AGSTT

| Date | Event |

| 31 October 2024 | AGSTT reports 2QFY2025 Results, Cash flow from operations deteriorates |

| 04 November 2024 | 2QFY2025 Results Analysts Call |

| 04 February 2025 | CRISIL Downgrades AGSTT to ‘D’ from A/Stable Cites default on bank loans in end December 2024 |

| 04 February 2025 | India Rating Downgrades AGSTT to ‘IND D’ from ‘IND A/Stable’ |

| 10 February 2025 | AGSTT informs exchanges that it has defaulted on payments and statutory dues |

| 15 February 2025 | AGSTT reports 3QFY2025 Results, Auditor casts doubt on Group’s ability to continue as a going concern |

Source: AGSTT

On October 31, 2024, AGSTT reported its consolidated 2QFY2025 results. These results should have been thoroughly analysed by both CRAs which had issued ratings on the company, but neither firm did so. Either they simply did not analyse the results, or they believed there was nothing in them of significance for lenders to the company.

In 1HFY2025, while the company’s revenue from operations declined by 7.5% (year-on-year), it reported a net profit as compared with a net loss in 1HFY2024. The turnaround to reporting profits was illusory, as there was a significant build-up in receivables and to lesser extent decline in payables, which resulted in a lower net cash from operations as compared with 1HFY2024.

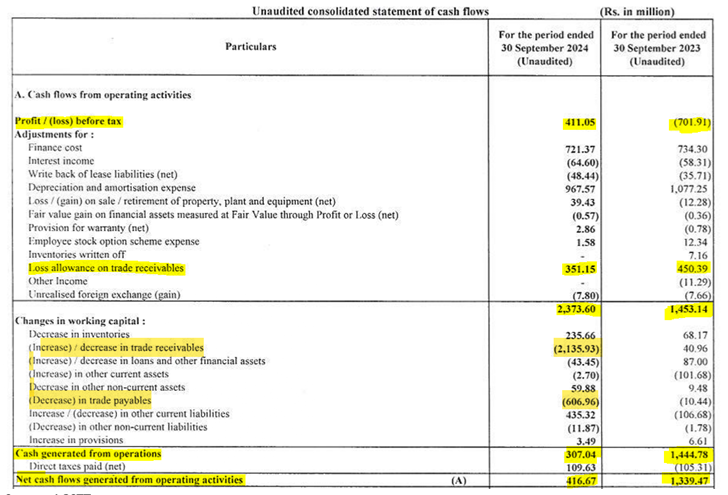

Extract of AGSTT cash flow from operations

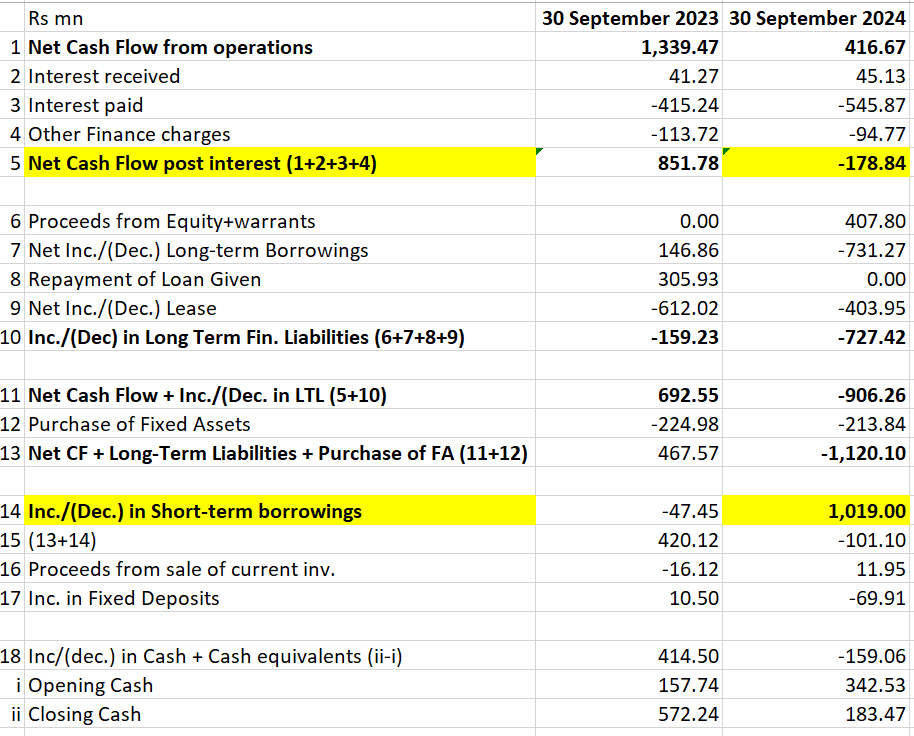

Factoring interest outflows, the company had a negative net cash flow from operations. This was a major negative development which should have been immediately highlighted by the CRAs, as the profits reported by the company were ‘paper profits’ i.e. not supported by cash flows. The problem got compounded as the company raised only Rs 408 mn via equity, which was insufficient to repay long-term borrowings of Rs 731 mn, lease repayments of Rs 404 mn and capital expenditure of Rs 214 mn.

Cash Flow Statement of AGSTT for period ended 30th September

The company resorted to raising additional short-term borrowings of Rs 1 billion to discharge long-term payments of repaying long-term debt and financing capital expenditure. When cash flows from operations are either negative or insufficient, a prudent financial strategy is to raise long-term funds to meet long-term obligations such as redeeming long-term debt and capital expenditure. Utilising short-term funds for long-term uses is a high-risk financial strategy which bankers are reluctant to fund. This was the second glaring red light which the CRAs ignored.

When a firm’s debtors grow much more than warranted, banks become cautious, as this development demonstrates poor working capital management and possible funds diversion/siphoning. And when the company diverts short-term borrowings for long-term purposes, prudent banks would immediately curtail additional short-term lending. Even on the 2QFY2025 results call held on November 4, 2024, analysts were raising questions regarding the company’s high receivables. Apparently, AGSTT’s poor working capital management and imprudent financial strategy continued in October-December 2024, resulting in an acute fund crunch, as banks did not extend further short-term funds; bank limits were fully utilised, resulting in the company defaulting on its statutory dues and bank borrowings.

As per CRAs’ agreements with the companies, they rate normally receive monthly updates from the company which are not public information. The point of CRAs receiving such non-public information is for them to provide a deeper insight into the creditworthiness of the companies they rate. But in the case of AGSTT, both CRISIL and India Rating have demonstrated their inability to even undertake basic financial analysis of the all-important cash flow statement, which was a public disclosure. Worse, CRISIL only downgraded the rating to default when they were informed by Bank of India on January 29, 2025 that a default had occurred.

Responding to a query sent by this analyst to CRISIL on why the CRA did not release an update post AGSTT’s 2QFY2025 results on October 31, 2024 and caution investors CRISIL stated,

“As we have mentioned in our rating rationale, the company had misrepresented facts to Crisil Ratings by stating that they have adequate means to support upcoming debt obligations.

We would like to state that Crisil Ratings maintains all its outstanding ratings – including that of AGS Transact – under ongoing surveillance. We have attached Crisil Ratings’ last rating rationale dated June 21, 2024, which while capturing the downgrade in the rating of AGS Transact, also highlighted our views on the receivables issue as follows:

‘Even the recovery from the debtors overdue for more than two years has been lower than expected. On contrary, the company did further provisioning of ~Rs. 71 crores [Rs 710 mn] in H2FY24, adding to ~Rs 45 crores [Rs 450 mn] taken in H1FY24. The provisioning done over the last two fiscals has significantly impacted the company’s networth and thereby its financial risk profile. However, it will likely improve going ahead with the planned equity infusion of up to Rs 200 crores [Rs 2 bn] as per the latest BSE announcement. Timely infusion of equity, significant improvement in operating performance and no significant provisioning in the coming quarters will remain key rating monitorable.’”

CRISIL’s response acknowledges that it was concerned regarding the overdue debtors at the end of 1QFY2025, i.e., in June 2024. But this only makes it all the stranger that they proceeded to fall asleep in October 2024, and completely failed to highlight the significant deterioration in 2QFY2025.

It is pertinent to note that CRISIL and India Rating not only maintained an ‘A’ rating for AGSTT after the announcement of its 2QFY2025 results on October 31, 2024, but also continued with a stable outlook, which is meant to indicate there would be no negative developments in the immediate future.

As per CRISIL’s own rating criteria, securities with an ‘A’ rating,

“…are considered to have adequate degree of safety regarding timely servicing of financial obligations. Such securities carry low credit risk”

For CRAs to downgrade an ‘A’ rated security by 5 grades to ‘D’ (default) in a single move after a default is a public demonstration of professional misconduct, and the Securities and Exchange Board of India (SEBI), as the regulator, needs to investigate and take action. Such actions by CRAs undermine confidence in the capital market, as credit rating is the primary determinant for pricing/secondary trading of debt securities. The objective of rating is to keep the public informed and to enable them to take informed decisions on investments.

Supposedly, having multiple CRAs operating should ensure greater vigilance. It is not a good sign that not one, but two, CRAs in this case were asleep at the wheel. Both managed to miss the signs that were available in publicly disclosed information, let alone the non-public reporting to which they had access.

It is inexcusable for CRAs to ignore a company’s publicly available cash flow statement. AGSTT’s cash flow statement revealed not only that its cash flow from operations, after factoring interest payments, was negative, but also that it was pursuing a high-risk strategy of utilising short-term borrowings for long-term purposes. The signs of deteriorating liquidity and its causes were visible in the 2QFY2025 results, but these were ignored by the CRAs, who chose to remain ignorant. Such ignorance though cannot be excused or condoned by the capital market and the regulator.

CRISIL’s website reports a total of 19 downgrades for the period April-September 2024; 13 are by one notch (notches include plus and minus), 5 are by two notches, and 1 is by three notches. AGSTT is not mentioned, as it was discovered only after its actual default in end December 2024.

Are there more such? It is up to SEBI to find out.

Disclosure: I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). Please see SEBI disclosure here. My BSE enlistment number is 5036. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in Yes Bank and Bank of India. Views expressed in this insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this insight or hold any specific opinion on the securities referenced therein. This insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

This article first appeared on Hemindra Hazari’s blog and has been republished with permission.