BJP’s Narrow Win Signals Anti-Incumbency, Modi's Waning Popularity and Journey to an ‘Anischit Kaal’

The people’s court has spoken and the NDA, which claimed 293 Lok Sabha seats, is set to return for a third term, but the mandate is not exactly what Prime Minister Narendra Modi may have hoped for.

The results were in contrast to exit polls, most of which predicted a 350+ seat victory for the NDA. The BJP, which crossed the majority mark of 272 seats in the 2014 and 2019 elections, won only 241 seats this time, which means it will need the rest of the NDA’s – especially the Janata Dal (United) and Telugu Desam Party’s – help to govern as a coalition government.

Some of the western and northern states sprung a surprise for the incumbent BJP, which lacked a clear national election narrative while facing concerns of significant economic distress (as discussed here) in rural areas, where the opposition has dramatically gained (in both seats and vote share against the BJP).

See how Uttar Pradesh’s 80 seats saw a split outcome on seat share, with 35 going to the NDA and 44 for INDIA, while out of Rajasthan’s 25 seats, 14 went to the BJP and 11 to INDIA.

BJP+ reportedly won a vote share of 44.12% in UP (with the BJP winning 42.13%), INDIA won 42.7% (SP: 31.98%, INC: 10.64%), and the BSP 9.2%. Srinivasan Ramani reports that there was a massive increase in the INDIA parties’ vote share in the state.

Ramani also reports that in major cities, the NDA won 52.8% of the vote share compared to 48% in 2019, but that in semi-urban, semi-rural and rural seats, the alliance won 39.9% vs 42.5%, 37.3% vs 42% and 44.1% respectively as compared to 42.5%, 42% and 44.9% in the last election. “[It’s] the mofussil towns where the BJP has had a fall,” he says.

The mandate of the Indian electorate, with the gains made by the Congress and its INDIA allies, gives a clear indication of a strong anti-incumbency wave (drawn from shared sentiments of increasing economic resentment and electoral disappointment against the incumbent) that was evident on the ground both against Modi and the BJP.

Economic issues of persistent price-rise (inflation); jobless growth; slow private investment; real wage stagnation; widening wealth-income inequality; poor economic incentive-led schemes (like PLI) at the cost of decreasing allocations for essential social welfare programs (MGNREGA, Nutrition Programs etc.); etc. are all factors that have most people – especially in rural areas – in the north, west and parts of the south voted heavily against the BJP.

It is likely that these rural and semi-urban electorate clusters will continue to be deeply impacted by these issues in the future too.

What is also evident now is the degree to which the exit polls got their predictions of a ‘landslide win for the BJP and the NDA’ wrong. Short-sellers in the stock market made gains from these predictions only to witness one of the largest falls in both Sensex and Nifty stock prices in recent months. The Sensex went down by more than 5,500 points.

The intra-day stock market collapse raises serious questions on the extent to which market traders profited from a recent spike in stock trends established by the ‘irrational exuberance’ of the ill-conceived, poorly designed, biased projection of exit polls.

Also read: Modi Stands Defeated But He’s Not Giving Up His Destructive Plan for a Thousand Year Raj

There is a need to seriously question the design and methodological framework of how exit polls were created – almost to favour or create the false pretence of a BJP landslide win. Maybe those who were aware of ground realities also operated under a fear of not upsetting the incumbent party’s leaders, which says a lot about the nature of the mainstream media’s capture and the intellectual insincerity observed in the Modi era.

With a reasonable win for the NDA, despite it faring worse than 2014 and 2019, India’s economic situation may continue to be marred with structural issues even as the nature of its future political scenario may continue to surprise many.

Despite a narrower win secured by the NDA, a few key structural issues in the state of the Indian economy still remain.

The status quo is more likely to continue (or perhaps worsen), if Modi 3.0 (like Modi 2.0 and Modi 1.0) continues to reflect an ecosystem of intellectual bankruptcy and policy amnesia, combined with a fundamental lack of clarity in shaping India’s core economic agenda for the goals the government seeks to achieve (at least in theory) on developmental objectives.

This author has earlier argued that in India’s contemporary political history, no single, strong leader has had a ‘smooth’ or assertive third-elected term (be it Jawaharlal Nehru or Indira Gandhi in the past). We are moving in that direction for Modi too.

Modi’s challenge ahead in his third term – with a weaker BJP mandate – would be to secure the vision of a ‘Viksit Bharat’ (developed India) for all citizenry based on a holistic, inclusive model of development as against continuing to follow his government’s failed model of supply-side led, trickle-down economics that hasn’t worked well in handling the Indian economy.

I discuss here (to echo) three key structural issues that may continue to afflict India’s economic as well as broader political economy landscape that lies ahead, despite the NDA’s win and Modi’s undisputed reign as elected prime minister.

The first undercurrent: the deepening of income, wealth and access-based inequalities.

Second: a rupture in India’s disjointed, fractured labour markets, further accentuated by uncertain global headwinds (and widened tech-shocks that are rapidly substituting capital over labour across production and distribution-based supply chains).

The third: historical policy amnesia on India’s growth trajectory, amidst a higher output-employment gap combined with high unemployment (especially amongst the educated youth), weak worker contracts (for those employed in an informalising, unorganised landscape) and a disturbingly low female-male labour force participation rate.

Widening inequalities

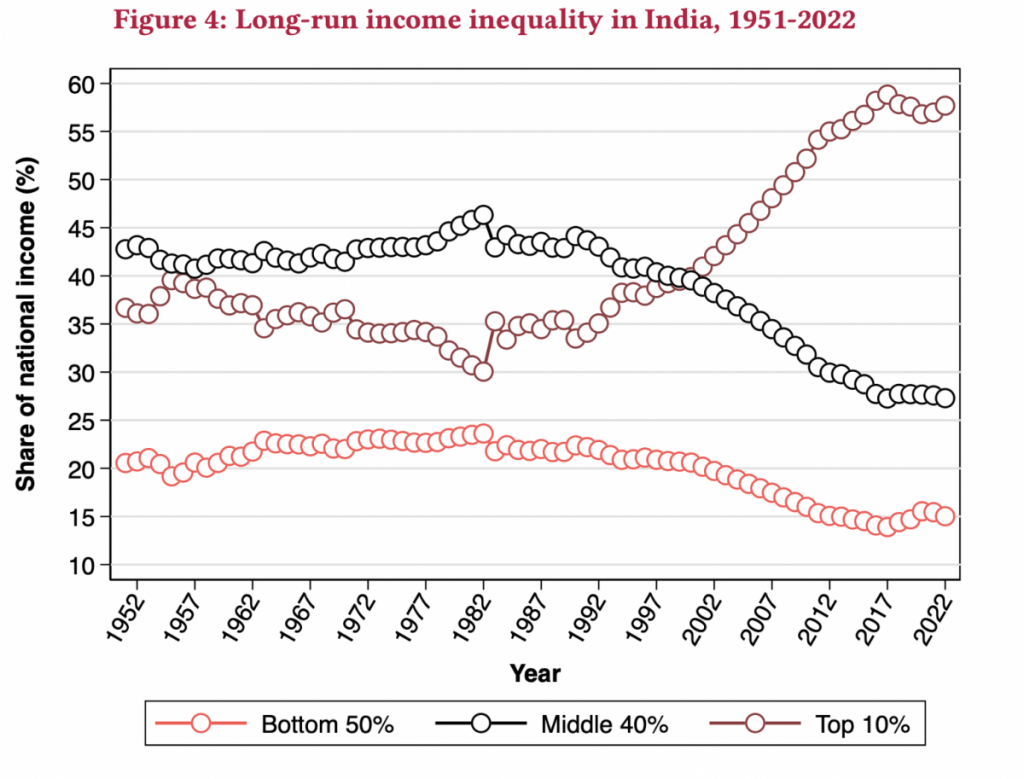

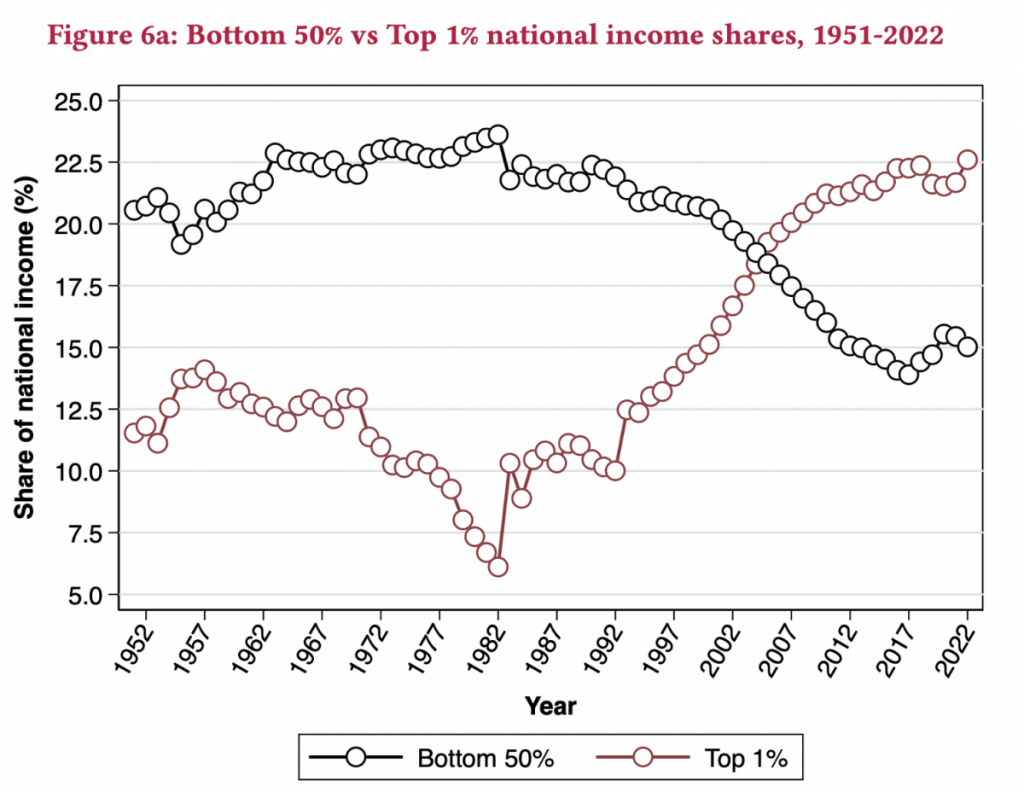

To understand the first undercurrent/fault line, it may be helpful to look closely at data from the World Inequality Report 2023. The study notes how the top 1% of income earners in India control over 40% of its total wealth, up from 12.5% in 1980.

The top 1% income earners made 22.6% of the total pre-tax income, up from 7.3% in 1980.

Chart: Bharti et al. (2024).

According to the authors’ latest estimates, it takes just Rs 2.9 lakh a year to join the top 10% of income earners and Rs 20.7 lakh a year to join the top 1%.

They observe:

“By contrast, the median adult earns only around Rs 1 lakh a year, while the poorest of the poor have virtually no incomes. The bottom half of the distribution (50% of adults) earns only 15% of the total national income. Since wealth is a major source of future economic gains, and of power and influence, it presages even more increases in inequality.”

See figures below.

Chart: Bharti et al. (2024).

Expanding upon this, as studied by our Centre for New Economics Studies, in creating its Access (In)equality Index (AEI) for states across India, the scenario for ‘access inequality’ to basic economic, social opportunities and public goods has worsened over time (see here for more details and a brief summary on what we find from AEI’s results).

It would be interesting to see how states and regions with higher access inequality performed in terms of vote share (BJP vs INDIA), and if an anti-incumbency wave existed at the national level.

Going back to Bharti et al. (2024)’s estimates on widening inequities, the wealth of the top 10% globally, which constitutes the middle-class in rich countries and the merely rich in poor countries, is growing slower than the world average.

Those in the top 0.1% saw their share of wealth rising from 7% to 11% in just a year, as is evident from the stock market boom and rise in corporate profits of the top billionaire firms.

In India, the top 1% of the population earned more than 21.7% of its total national income in 2021, while the bottom 50% made 13.1% of the national income. The authors of the World Inequality Report argue that the deregulation and economic liberalisation policies pursued since the 1980s resulted in an extreme increase in income and wealth inequality (as explained here).

The Modi government – the prime minister in particular – has ignored the issue of widening inequality – and was found sarcastically ignoring the issue when confronted in a recent pre-election interview with Aaj Tak.

This is far more troubling and signals a weak moral compass and a lack of political leadership to address structural issues that affect the livelihood and socio-economic profile of Indians.

Labour market shake-up: widening unemployment-underemployment

In understanding the second and third undercurrents, we need to dig deeper to study the labour market, particularly from the perspective of the last two years.

In India, the abysmal labour market landscape for ‘job seekers’ continues to be in bad shape.

Periodic Labour Force Survey (PLFS) data for January-March 2024, released earlier this year, shows how the unemployment situation is still quite poor in the country (particularly when observed in terms of employment rate amongst educated males and females, including in ‘job creating’ urban areas), while rural underemployment and distress has worsened.

According to the PLFS quarterly bulletin released on February 12, 2024, the unemployment rate in urban areas went down to 6.5% in the December 2023 quarter from 6.6% in the previous quarter.

Male unemployment declined from 6% to 5.8%, female unemployment remained the same at 8.6%.

The labour force participation rate (LFPR) in urban areas increased slightly to 49.9% in the December 2023 quarter from 49.3% in the previous quarter.

LFPR increased among both males and females. For females it increased from 24% in the September 2023 quarter to 25% in the December 2023 quarter, and for males it increased from 73.8% to 74.1%.

Also read | Some Proof Required: Modi Govt’s Abysmal Record of No Jobs

Employment, when measured as the worker population rate (WPR), increased to 46.6% in the December 2023 quarter from 46% in the September 2023 quarter. Male WPR increased from 69.4% to 69.8%, and female WPR increased from 21.9% to 22.9%.

There is still a lot of work to be done in the context of India’s weak employment rate and jobless growth scenario, combined with the inability to create ‘good jobs’ for those seeking employment. It is baffling how, despite the unemployment distress, the BJP’s vote share in many affected states has virtually remained the same in 2024.

The rise of ‘functional illiteracy’ (as discussed here) amongst the more educated/trained youth, when compared with the global employment competitiveness level, still remains a structural concern despite the overenthusiastic image created around India’s macro-investment outlook and ability to draw more capital inwards (even though the FDI story tells us how bad the last decade has been for private investment and capital formation in India).

There are issues with the growth story too, which has been a subject of intense debate in the recent past (based on the growth data coming out).

As Adrija Chatterjee says, a number worth highlighting today is that India's “blockbuster” 8.2% GDP growth in FY24 “came with a farm growth of just 1.4% and a 20-year low private consumption level.”

It tells us very clearly what is wrong with the growth trajectory and its sectoral composition performance scenario.

A crisis of ‘inclusive growth’ amid sectoral growth composition mismatch

In terms of growth composition, overall output numbers for the same period (11.6% at the end of December) show signs of marginal improvement compared to 9.4% seen in September, and services continued to outpace manufacturing activity.

However, private consumption and macro-private investment growth still appears to be weak.

As argued before, while reviewing the macro-elements and components of growth, in any statistical interpretation exercise, it’s difficult to get the full picture one needs.

For example, keeping aside the base effect, the fact that private consumption demand is still woefully low indicates how much of the low-middle income and poorer-income class in India is ‘consuming less’ and their group’s demand remains compressed.

The government has treated this class as an entitlement-based beneficiary group, especially in states (in west and north India) where their economic condition has worsened.

What’s vital while analysing the current numbers is to not be swayed by the interpretive meaning of recent trends or to take a short-term view of the numbers, but rather to view India’s macro-growth composition and its pattern in the context of broad-based historical facts.

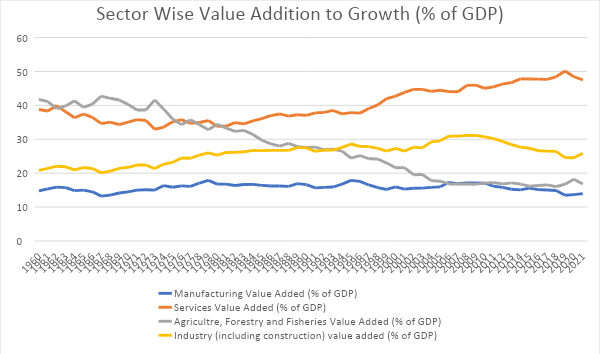

For one, the weakness of the manufacturing sector (discussed at length here) isn’t part of some new trend, but is reflected in the historical pattern of Indian growth’s sectoral composition and in its employment pattern too.

Chart: Author’s calculations from the World Bank’s database.

In terms of sector-wise value addition to growth (as a % of the GDP), India’s manufacturing sector has almost remained at the same level since the 1960s (I explained some of the reasons behind this here).

Industry (including construction) added more to the Indian GDP after the mid-1970s, but at an incremental rate, as workers from rural areas left agriculture and migrated to cities for work.

The agriculture, forestry and fisheries sector waned in terms of its value addition to the GDP, despite most of India’s rural population being employed by this one sector.

Service, on the other hand, with its rising value addition to GDP growth, particularly after the mid-1990s, became part of India’s urban growth narrative.

But there’s a twist to this that has historical precedence.

Why India’s growth has historically remained exclusionary in nature and may continue to remain so under Modi

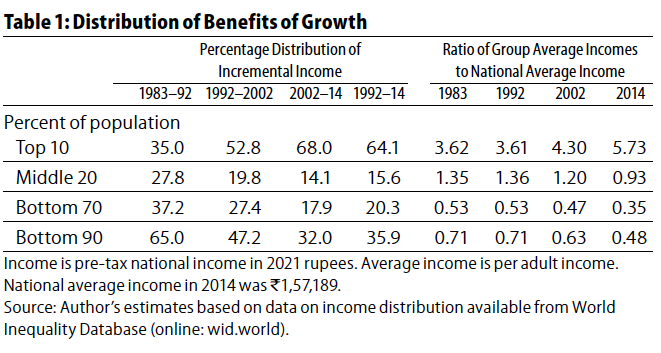

According to development economist Ajit Ghose’s seminal work and recent 2023 paper, a closer look at India’s growth-employment data indicates how, since the early 1990s, India’s economy has experienced a pattern of “exclusive growth” – in other words, growth that benefited the urban rich.

“The richest 10% of the population has been the recipient of a large and growing share of the incremental income generated by growth,” Ghose says.

Based on the distribution of the benefits of growth (in terms of income) amongst the percentage of population as seen in the table below, sourced from Ghose’ paper, it is clear that India’s national income became increasingly concentrated among a small group, consisting of those who were already rich, in the post-1992 period.

Table: Ghose (2023).

“Even the middle class failed to develop; persons or households commonly regarded as belonging to the middle class in India belong to the richest 10%,” Ghose points out.

Another trend in the historical data that intersectionally helps validate the exclusionary growth tale is what’s happened in India’s overall employment pattern.

According to Ghose, “employment of the skilled – the rich – has been (still) growing while the low skilled – the poor – have suffered progressive exclusion from employment.”

He also says: “What emerges is that the source of exclusive growth lies in the nature and characteristics of the lead sectors, namely “skill-intensive services.”

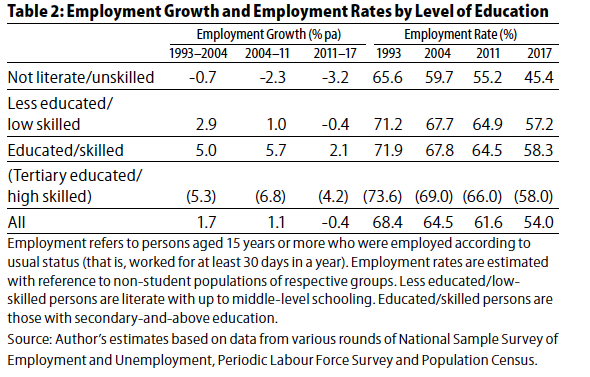

Table: Ghose (2023).

“Overall employment growth, low to begin with (just 1.7% per annum during 1993–2004), decelerated rapidly after 2004 and turned negative after 2011. The rapid deceleration was due, in large measure, to the progressive exclusion of unskilled and low-skilled workers from employment”, Ghose argues.

As seen in Table 2 above, employment among the unskilled decreased at an increasing rate in the years between 1993 and 2017. Employment growth among the low-skilled also decelerated and turned negative in the period 2011-17.

Even the growth of employment among the skilled sharply decelerated after 2011 – when the last census was conducted – and while growth created jobs “basically for the skilled, it did not create enough jobs even for them in this period”, Ghose says.

Under Modi, we have seen an even more rapid decline in the employment rate amongst semi-skilled workers in areas where (earlier) ‘new’ jobs were being created, despite being subjected to weak, more exploitative worker contracts.

A demand-side crisis hasn’t helped in allowing any major supply-side economic policy intervention to work (see the failure of the Make in India campaign or the PLI scheme’s mixed success, for example).

These are all indications (with historical validity) of the anti-incumbency wave that brought the BJP down to below 250 (in won seats), signalling the experience of an Anishchit Kaal (uncertain age) for India and Indians amidst a structural, endemic crisis of widening inequality, a disjointed labour market fracture and widening output-employment gap.

It’s optimistic to see INDIA gaining its electoral tally (in both seats and vote share) and the spirit of electoral democracy kicking and alive in India. However, on policy, unless a giant leap of change comes about in the country’s economic policy ecosystem in Modi 3.0, the hope (and expectation) to drive real change may remain dismally low.

Deepanshu Mohan is Professor of Economics, Dean, IDEAS, Office of InterDisciplinary Studies, and Director, Centre for New Economics Studies (CNES), O.P. Jindal Global University. He is a Visiting Professor at the London School of Economics and a 2024 Fall Academic Visitor to Faculty of Asian and Middle Eastern Studies, University of Oxford. He has held Visiting Professorships with University of London’s Birkbeck College (UK), University of Ottawa (Canada), Carleton University (Canada), Stellenbosch University (South Africa), FGV (Rio, Brazil) in the past.

This article went live on June sixth, two thousand twenty four, at twenty minutes past seven in the evening.The Wire is now on WhatsApp. Follow our channel for sharp analysis and opinions on the latest developments.