Are Government Freebies Under PLI Scheme Truly Necessary to Enhance Manufacturing in India?

There is much press discussion of the Production Linked Incentives (PLI) scheme in India without any serious attempt at evaluation. Government spokespersons, associated political actors, and TV personalities (typically non-economists) talk about the increase in mobile exports as “proof” the PLI scheme is working. We need a more sensible discussion of the merits and demerits of an important scheme in which lakhs of crores of taxpayer money are being promised. Hence this note.

What is the PLI scheme? Essentially, it starts from the premise that India manufactures too little. But why is this so? The government says, for example, that the electronics sector suffers a competitive disadvantage of around 8.5% to 11% on account of factors such as the lack of adequate infrastructure in India, the high cost of finance; the inadequate availability of quality power; the limited design capabilities in industry and its neglect of R&D; and the inadequacies in skills of Indian workers. Since addressing these weaknesses will take time, the government wants a faster alternative.

The scheme essentially pays manufacturers a sum (usually a fraction of sale price) for every unit produced (say mobile phones). In addition, state governments offer tax incentives such as GST waiver and power and land subsidies for locating in their state. How should India evaluate the value of this scheme? Here is a list of questions worth asking.

1. Would investment have taken place even without the incentives?

- Apple using India for cell phone assembly is no proof that PLI is working. Apple is looking for alternatives to China. The growing Indian market is a big attraction. It may be that the PLI scheme tipped Apple over the edge. It may equally be they came for other reasons.

- Similarly, PLIs to industries where large industrialists were anyway going to make investments is a pure freebie to them. That they invest and produce cannot be seen as a “success”.

- This is why the process by which the government decides which industries are to be favoured has to be transparent, and open to questioning by the interested public. It is not.

2. If the answer to the first question is no, we need to ask a second question after the scheme starts running: How much is it contributing to increasing our external surplus (or rather, reducing our deficit)?

- The PLI scheme pays a manufacturer a sum for every unit that leaves the factory. It cannot tie the sum to how much value has been added for that would violate WTO rules.

- This is why an increase in exports is no proof of the success of the scheme. If I am a mobile manufacturer in Taiwan, and India is paying me PLI for every cell phone that leaves my factory in India, I simply ship all parts to India, assembly the phone there, and get a hefty reward from the Indian taxpayer for every cell phone I “manufacture”.

- Put differently, the more of the final value is produced in India, the more jobs are created, and the more worthy the PLI scheme.

- The correct number to look at from the perspective of India’s external surplus is the change in (Value of Mobile Exports-Value of Imports) - Repatriated profits and royalties

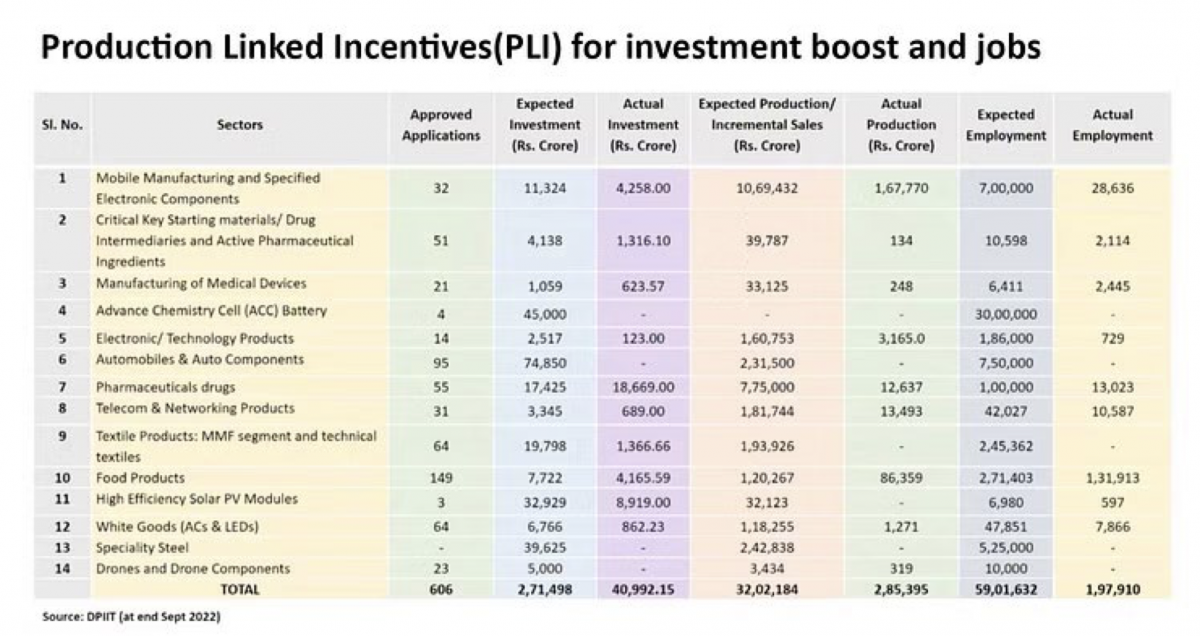

This is a crude measure of the incremental current account surplus generated by manufacturing in India, and includes any substitution of imports – if we imported mobile phones before and now produce them domestically, even for the domestic market, that shows up as an increase in net exports, the highlighted yellow term. - To its credit, DPIIT (a government department) put out figures thus far of investment and employment in industries that have benefited from PLI.

- As can be seen, the three most important industries as far as job creation so far are Food products, Mobile Manufacturing, and Pharmaceuticals.

- In Food products, around 54% of the expected investment has come in, while 49% of the expected jobs have been created.

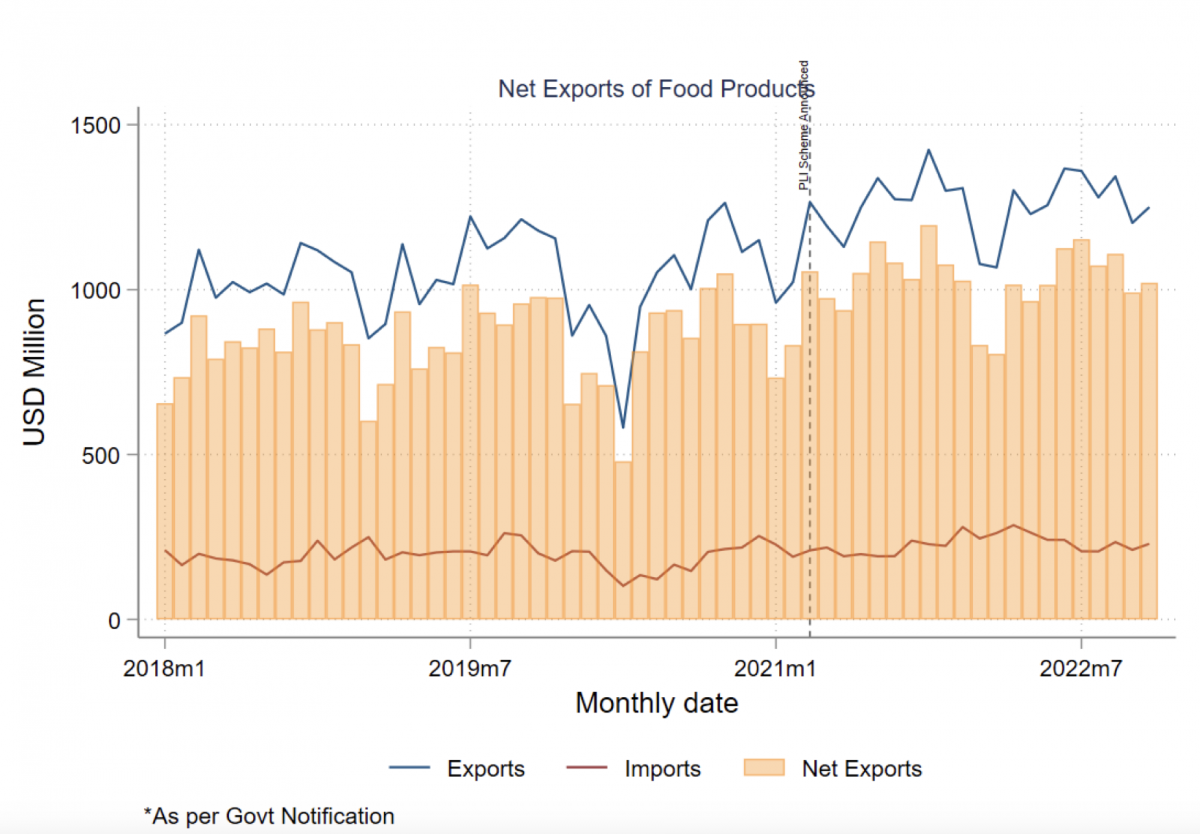

- Yet net exports in Food products do not seem to have increased significantly after the PLI scheme – the most recent month is about the same as the month of the announcement. There is a mild overall increase in dollars, but given that dollar inflation for food was about 10% in 2022, net export volumes may even have fallen.

- Turning to the next biggest employer, Mobile phones, 38% of expected investment has come in, but only 4% of the expected jobs – raising questions about how much labour-related value is being added in India.

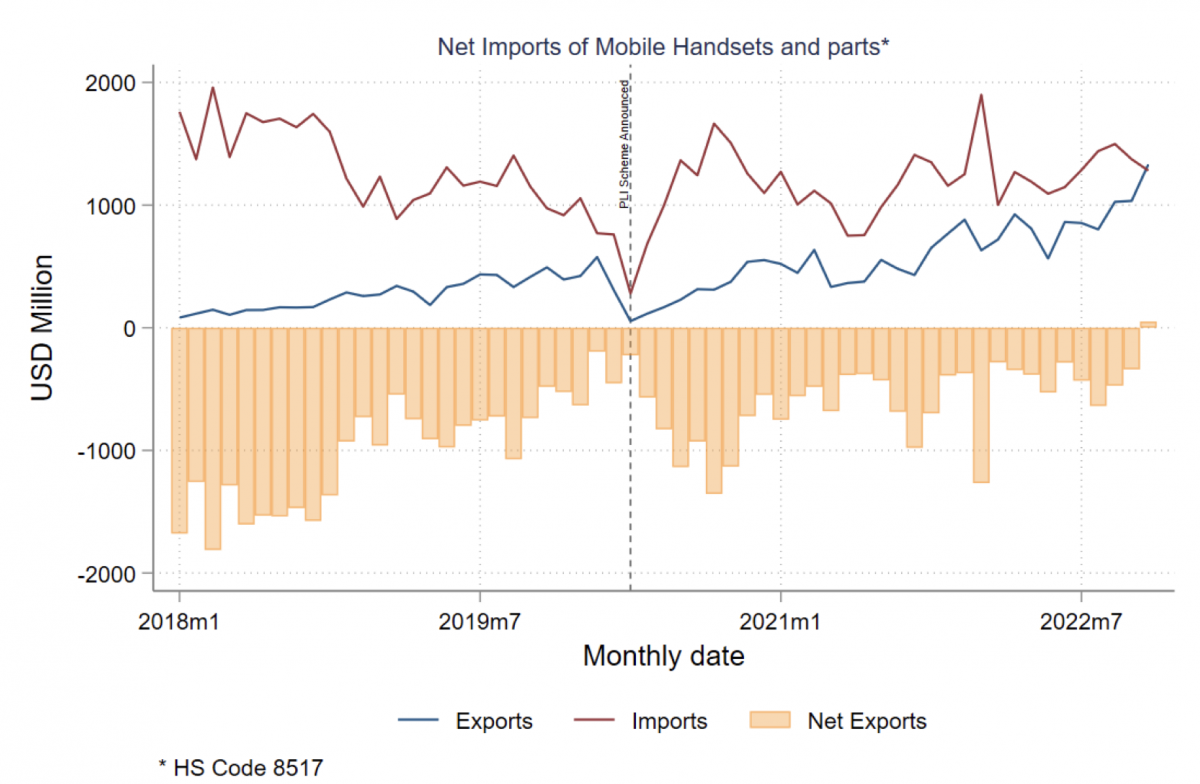

- While the value of mobile exports has been going up since the scheme started, the value of imports has also been going up, initially very significantly. So net exports turned significantly negative in the early days of the scheme. Since then, it has been going up and down with a tiny positive outturn in November 2022. This is why we cannot evaluate the PLI scheme simply by looking at exports.

- Importantly, the export price could also embed repatriated profits and royalties (the blue highlighted term – manufacturing content of a $1000 IPhone is about $300, with the rest being the services, royalties, and profits embedded in the mobile phone). Given that finished phones are now being sent from India by foreign manufacturers, it is important to subtract this element which reduces the positive impact on the external account for it will be repatriated as profits and royalties by the foreign manufacturer. Unfortunately, the “Repatriated profits and royalties" number is not easily available.

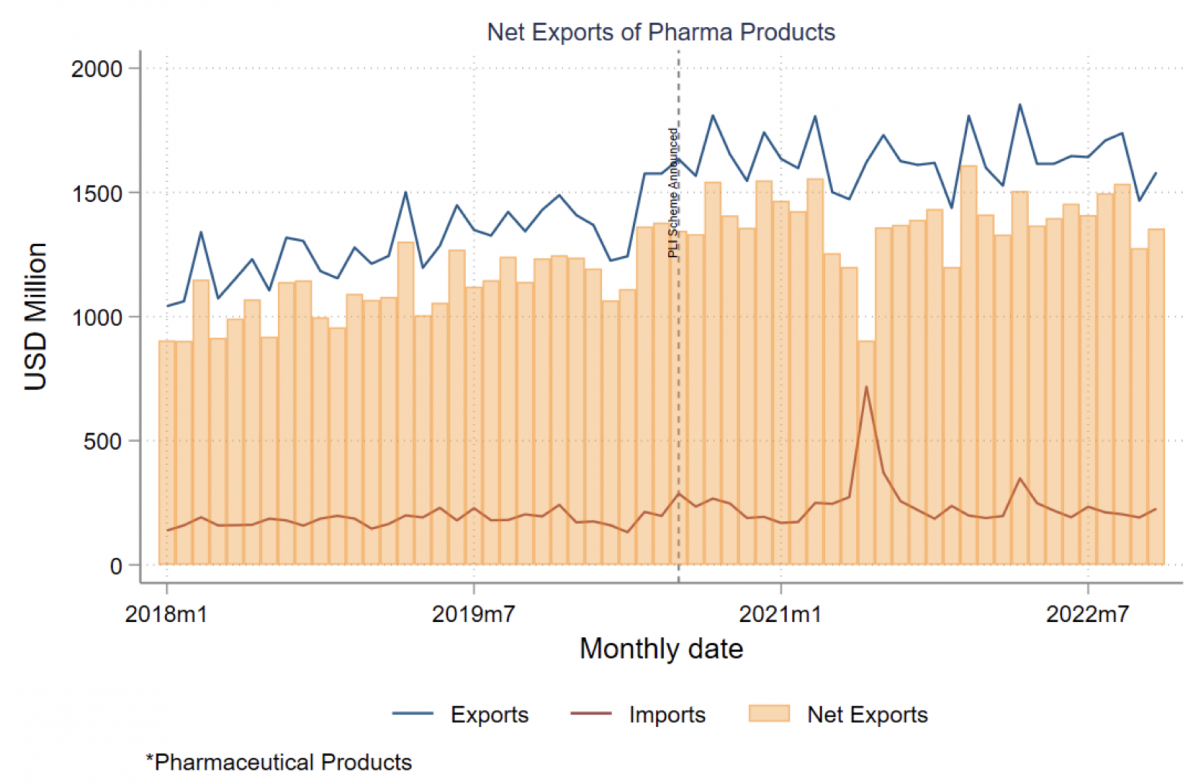

- Finally, turning to Pharmaceutical Drugs, this is probably where there was least need to give PLI incentives, given we had a thriving industry (similar concerns apply to auto parts).

- Once again, the graph shows little change in monthly net exports from just before the PLI scheme introduction and after. Investment, it turns out, has been 107% of that expected, but jobs created are 13% of those expected. Indeed, as with mobile phones, job creation seems to be a flop, partly because the extent of value added is probably far less than anticipated, given the nature of the scheme.

3. How much production will stay after PLI ends?

- Even if production comes to India, manufacturers must find it worthwhile to continue manufacturing in India after all the government-provided incentives end. This implies that they should bring substantial parts of the supply chain to India so they do not leave easily.

- Put differently, the more the value added in India the more sticky the investment will be. If it is just assembly, it can leave quickly. This is why the underperformance on jobs (a contributor to value added) in the government numbers has to be worrisome.

4. Is this the best use of government resources?

- The cost of the scheme, which should be set against the increased production, consists of PLI incentives plus net other tax incentives. It has not been accounted for in the discussion above.

- The government has a tight budget constraint, made more so as interest rates rise and debt servicing becomes difficult. Contracted PLI is a form of debt in that the government will owe manufacturers (and may not get much in the way of compensatory taxation if tax holidays have been provided).

- For instance, government can spend more money on creating high quality schools and universities, which allow us to create the brains that will power our future. Furthermore, schools and universities are employment-intensive services, far better than some of the industries being contemplated for PLI.

- For instance, the $10 billion seemingly set aside for subsidizing a $ 20 billion chip factory, with dubious prospects of success, could finance hundreds of top universities (including upgrading existing ones) and thousands of top schools. Simply educating our people well, engaging in research and development, and aspiring even to train students from other developing countries would be a large industry in itself, in addition to the large externalities it would generate for the economy and society.

- Finally, tens of thousands of trained computer scientists could produce the chip designs that a capital intensive chip foundry in a friendly country could make chips out off. Qualcomm and Broadcom, companies worth hundreds of billions of dollars, and Apple worth trillions, make no chips of their own. Is it better to create human capital or subsidize physical capital? Is it better to create Apple or TSMC (the Taiwanese chip maker)?

To state the obvious, we are not against manufacturing as a means to better livelihoods, no right thinking economist would be. India surely needs a much stronger manufacturing base. And it is early days yet for the PLI scheme.

- But is a scheme that doles out freebies to the biggest domestic and foreign manufacturers the best way to go? How about tackling the infirmities that PLI is meant to compensate for instead? What about better human-capital oriented PLI where we pay skilling firms based on the high-quality jobs their trainees get and keep?

- Before expanding the scheme much more based on dubious metrics of success, don’t we need more data about its performance, at least in the industries where the scheme has run for some time? Should it worry us that job creation is far below that expected, even as investment has come in? It would be worthwhile to know how many quality jobs are being created per rupee of government incentives. Once again, there is no evidence that such an analysis has been done.

- For proper assessment, the government has to make more data available – the DPIIT table above is a welcome beginning, and the government’s Chief Economic Advisor should be commended for drawing attention to it.

- But without more analysis, we cannot reject the possibility that this is an enormous and possibly misdirected transfer of public resources to large domestic and foreign firms. The protestations of industrialists and their champions that PLI is a great scheme is of little value – they are interested parties. The argument that other countries do it is silly – it substitutes imitation for thinking. And if imitation of our East Asian exemplars is so beneficial, why do we continue increasing tariffs?

- The public deserves more information and a more informed debate when lakhs of crores of public money are at stake. If it is not going to create the crores of jobs India needs (thus far, the scheme has created 3% of the anticipated additional employment of 0.6 crores, while 15 percent of anticipated investment has already come in), the sooner we shift to schemes that will work, the better.

This article was originally published on Raghuram Rajan's LinkedIn profile.

This article went live on January twenty-fourth, two thousand twenty three, at thirty minutes past five in the evening.The Wire is now on WhatsApp. Follow our channel for sharp analysis and opinions on the latest developments.