Hindenburg Report: Silence from Government and Absurd Statements Further Erode India's Credibility

The manner in which India’s market regulator, the Securities & Exchange Board of India (SEBI), has gone about investigating the astounding rise in share prices of the Adani group has been troubling for independent observers, even before Hindenburg Research, a US-based firm that specialises in forensic financial research, released its explosive report 18 months ago. This harks back to the tenure of another chairman who is now associated with the concerned industry group, but it was always assumed that SEBI’s reluctance was primarily due to political compulsions.

Having ignored the inexplicable price run-up, SEBI, under the present chief, framed its post-Hindenburg investigation primarily on short-selling activities. Even a novice investor understands that short-selling opportunities emerge only when stock prices soar far beyond a company’s fundamentals or future prospects. The explosive new ‘whistle-blower’ documents released by Hindenburg Research on August 10 give a new twist to the issue and have led to a full-blown credibility crisis at the market regulator. They question chairperson Madhabi Puri Buch's (MPB) personal integrity and ‘disclosures’ with a set of facts and documents.

As one of the top-5 capital markets in the world and a key resource mobiliser for the Indian economy, restoring confidence in the independence of our regulatory mechanism is of paramount importance today. What we are witnessing, instead, is a textbook example of how not to handle such a situation. In the 36 hours since Hindenburg released its sensational allegations, there was complete silence from the government and the finance ministry which oversees SEBI. Instead, we have seen a series of statements from those involved which raise more questions than they answer.

SEBI’s response, issued late on a Sunday night, is particularly disappointing. It claims to address issues that “warrant an appropriate response.” However, when serious allegations are made against the chairperson and the regulator itself, an ‘appropriate response’ cannot be anonymous. It should come from those in a position to speak for the regulator – which is either the board of directors or the finance ministry. Was there a board meeting? Who has assumed responsibility for statements made in the press release?

Exhibiting a poor understanding of the gravity of the crisis, its various actions in the Adani matter suggest that the issue is done and dusted barring one case. It also appears to defend the chairperson without any semblance of inquiry and states that she had “recused herself in matters of potential conflicts of interest.” Whether she did so in the Adani investigation is not clarified.

Meanwhile, the ruling party appears to have deployed a host of influencers to question Hindenburg’s credibility and to silence or discredit anyone attempting a serious analysis or comment. The strategy is unlikely to work. Unless the government takes responsibility and shows a willingness to conduct a fair inquiry, the pressure will only mount, it will also harm India’s credibility as an investment destination and hurt investors.

Despite the clarifications offered by various parties, including SEBI, many key issues warrant further scrutiny.

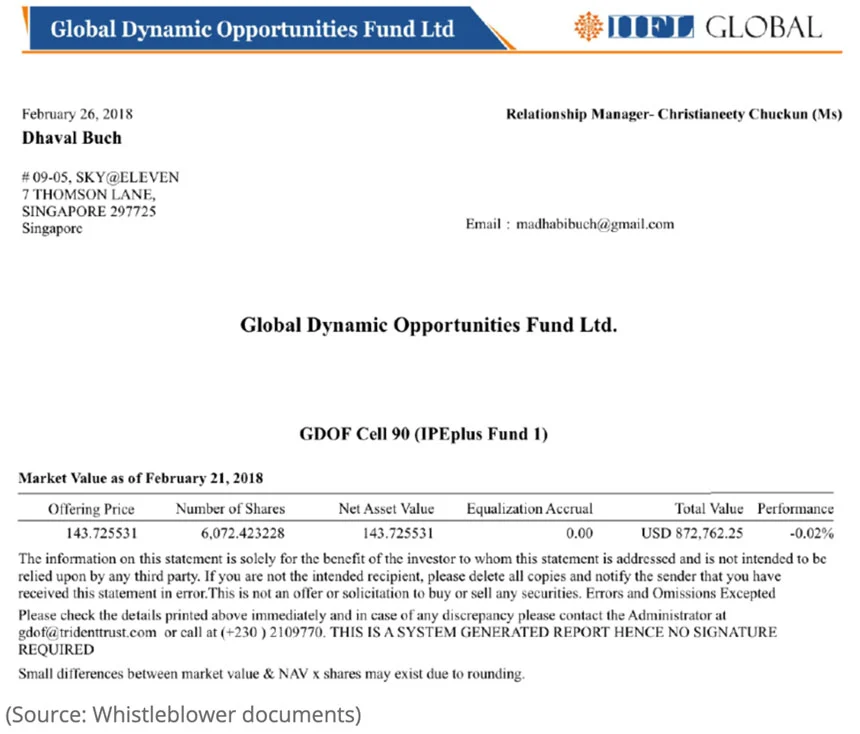

It is now an indisputable fact that MPB and her husband had investments in an offshore entity (Global Dynamic Opportunities Fund Ltd), which were nested in the same “obscure Bermuda/Mauritius fund structure” used by Vinod Adani, the brother of Gautam Adani, and was under SEBI’s investigation. They warranted clear disclosure, especially when the redemption process was rather strange.

Remember, SEBI itself has set a high bar for disclosure and compliance by regulated entities and their employees. A chairperson who tells influencers “You open your mouth and utter a single name (of securities), you stop being an educator and start being an adviser,” ought to play by similar rules. This means that an investigation that has dominated headlines, been reported around the world, and involved an unprecedented Supreme Court-appointed committee warranted disclosure and recusal.

Moreover, SEBI already has a precedent of CB Bhave being ring-fenced from a SEBI investigation into the National Securities Depository Ltd (NSDL) when he was appointed chairman, even though it did not involve personal investments. A board-monitored committee, perhaps comprising the three whole-time members (WTMs) could have been set up to handle the Adani investigation in consultation with the finance ministry.

Not only did it not happen, but it is clear that MPB led the investigation. She had two meetings with Gautam Adani while the investigations were ongoing. No disclosure of any recusal was made to the Supreme Court or to the expert committee that was specifically appointed to examine if there was “regulatory failure in contravention of laws pertaining to the securities market in relation to the Adani group.”

Subsequently, in April 2024, there were media leaks that investigations against 12 offshore funds that invested in Adani stocks would be settled while, in June 2024, SEBI sent a show-cause notice to Hindenburg (SEBI’s Charges against Hindenburg Put the Spotlight Back on Its Own String of Questionable Actions in the Past), despite questionable jurisdiction.

MPB’s dealings with Trident Trust Company are strange. First, there is a letter from Dhaval Buch asking their joint 'accounts be registered solely in his name'; yet, the email registered to the account remains that of MPB, who continues to receive investment details.

Redemption of offshore units: It probably explains why she sent a redemption request from her email in 2018 for redemption of Dhaval’s holding. How and why did the email not change? In India, this would have fallen foul of compliance requirements and possibly attracted penal action by SEBI. It also raises red flags about the real ownership of the accounts. As a WTM of SEBI and someone familiar with compliance rules, MPB was surely aware of this.

Agora consultancy: MPB and her husband have confirmed their holdings in two separate consultancy companies with the name Agora. MPB says she transferred her entire holding in Agora Partners Singapore to her husband, in March 2022. This was two weeks after she became SEBI chairman and in her second stint as regulator. She continues to hold a 99% stake in the India-registered Agora Advisory Pvt Ltd. In a public statement, the couple says the two entities “became immediately dormant on her appointment with SEBI” in 2017, but Hindenburg has released documents showing that the Indian entity is active and generating revenue.

In another contradiction, they say, Dhaval Buch started his own consultancy practice through these companies after retiring from Unilever. This not only confirms that Agora India is not dormant but it is unclear whether ‘prominent clients in the Indian industry’ that it does business with, are SEBI-regulated entities. This information is relevant since the SEBI chairperson remains a 99% owner of the firm, even if the consultancy is run by her husband.

FPI ownership disclosure: 360 One Wam Ltd (formerly IIFL Wealth Management) issued a statement revealing investment details of MPB and her husband, raising a crucial question from MP (member of Parliament) Mahua Moitra: if foreign portfolio investment (FPI) records down to the last natural person were made available so quickly by one entity, why did SEBI ’hit a wall’ in its investigation, as noted by the Supreme Court?

Even without going into the conflict issue raised by Hindenburg over Dhaval Buch’s consulting assignment with the Blackstone group, these allegations warrant clarity to restore the regulator’s credibility.

A small joint parliamentary committee (JPC) invariably turns into a political circus without the intended results. Former revenue secretary EAS Sarma has a better suggestion in his letter to the finance minister (FM). He suggests that the chief justice of the Supreme Court (which has not closed the Adani cases) could nominate a senior member of the judiciary to head an inquiry commission under the Commissions of Inquiry Act, 1952. It would make sense to accept this suggestion at the earliest.

India’s national interest is not served by defending one business group. With a market capitalisation of several lakh crores and the savings of countless ordinary people riding on the market, it is imperative that SEBI remains credible and is seen to adhere to the rules and compliance standards it imposes on all stakeholders.

This article first appeared on moneylife.in.

The Wire is now on WhatsApp. Follow our channel for sharp analysis and opinions on the latest developments.